When it first hit the market back in 2015, Moneybox gained a lot of traction for its simple round-up feature, which allowed you to round up your spending to the nearest pound and put the extra money into a savings point.

Fast forward nine years and the once-simple savings app is now a fully-fledged investment platform.

In this Moneybox review, I’ll share my personal experiences with the Moneybox platform, so you can get a good idea of whether it’s the right choice for you and your personal goals.

I’ll analyse the platform’s core features, rating them on a qualitative points-based scale. These points then translate into star ratings. For more information on how we test view here.

This article was reviewed by Tobi Opeyemi Amure, an investing expert and writer at Investopedia, Investing.com, and Trading.biz.

Don’t waste time!

Simply select the section you’re interested in, and we’ll guide you there right away.

Overall Rating – 4 stars

Overall, I give Moneybox a rating of 4 stars, based on an overall score of 71.8 and an average of 79.78%.

Moneybox is an excellent choice for anyone new to investing, who wants an easy-to-understand platform with a good range of long-term investment options.

However, advanced traders will likely find this platform useless, due to the limited range of markets, poor research tools and basic educational content.

While Moneybox’s round-up feature initially drew me in, it’s the psychological aspect that truly stands out. The platform’s approach of making investing feel like a natural extension of daily spending has fundamentally changed my relationship with money. For those struggling to build consistent investing habits, this behavioral “trick” could be the key to unlocking long-term wealth building.

Here’s a breakdown of how Moneybox performed in each category:

| Category | Points | Star ratings |

|---|---|---|

| Fees | 7.1 | 3.5 |

| Safety | 9.4 | 5 |

| Onboarding | 9.7 | 5 |

| Deposit & withdrawal methods | 8.6 | 4.5 |

| Markets | 5 | 2.5 |

| Tools | 6.8 | 3 |

| Investment & trading platform | 8.7 | 4.5 |

| Education | 7.7 | 3.5 |

| Customer service | 8.8 | 4.5 |

Here’s a rundown of the overall pros and cons of Moneybox:

Pros

- Simple platform to navigate

- Excellent onboarding and account selection

- Great platform for long-term investments

Cons

- Limited range of markets

- Lack of research tools

- Fees could be better

Fees – 3.5 stars

Moneybox doesn’t have a particularly attractive fee structure. Not only are the fees relatively high for investment accounts, but the fee structure is also pretty confusing and hard to predict.

Trading Fees

Because Moneybox is a savings and investment platform, rather than a trading platform, there are no trading fees per se.

Non-Trading Fees

Where the fees start to add up is through the non-trading fees.

For starters, all accounts, save SIPP accounts, must pay a £1 subscription fee per month. This isn’t exactly a deal breaker, but it’s still more than similar platforms such as Vanguard.

There’s also an annual platform fee of 0.45% of your total portfolio value. This means that, if your holdings equated to £10,000, you would pay an annual fee of £45. This is debited from your account in monthly payments.

For SIPP accounts, the platform fee drops to 0.15% for accounts holding over £100,000.

Finally, you must pay an annual fund provider fee. This varies between account types and fund providers but is generally in the range of 0.12-0.58% of your portfolio value. Luckily, Moneybox does provide a breakdown of these costs on its website.

Currency Conversion Fee

If your goal is to purchase individual stocks and shares denominated in various currencies, be aware of the associated conversion fees.

Currently, Moneybox exclusively offers individual stocks and shares from the US market, with a currency conversion fee of 0.45% applied to transactions involving USD. This fee is applicable both when purchasing and selling assets.

It’s essential to factor these conversion fees into your investment strategy to accurately assess the overall cost and potential returns, ensuring your decisions align with your financial objectives.

Furthermore, staying informed about any updates or changes in fee structures helps you make informed choices and optimize your investment experience with Moneybox.

Pros

- No trading fees

- Fund provider fees are laid out on the website

- Transparency in pricing

- Variety of investment options

Cons

- Monthly subscription fee

- Currency conversion fee

- Annual provider fee

- Annual platform fee

Safety – 5 stars

Moneybox is considered a very safe platform in the UK. It’s regulated by both the FCA and FSCS, meaning you’ll be protected should anything go wrong.

Track Record

Moneybox was founded in 2015 and has since displayed nearly a decade of excellent performance, and a stellar track record.

While not quite as extensive as other platforms like Saxo Markets, this background should give you the utmost confidence that your money will be safe with the platform.

FCA Regulation

Moneybox is regulated by the Financial Conduct Authority (FCA). This is the UK’s top regulatory body and ensures that Moneybox handles your money honestly and fairly.

Generally, if something is regulated by the FCA, you shouldn’t worry about safety.

FSCS Protection

In addition, all customers who invest through Moneybox are protected through the Financial Services Compensation Scheme (FSCS). This gives you protection up to the amount of £85,000, should Moneybox ever go bust.

Bank License

The only thing to note is that Moneybox does not hold a baking license, which means that it does not have to comply with some financial regulations.

However, considering the track record of the company, and the protection you’ll receive from the FCA and FSCS, you can rest assured that your money will be safe with Moneybox.

Pros

- FCA protection

- FSCS protection

- Great track record

Cons

- No baking license

Onboarding – 5 stars

I found it incredibly easy to sign up with Moneybox, and verification was particularly quick. The range of accounts is also excellent.

Account Selection

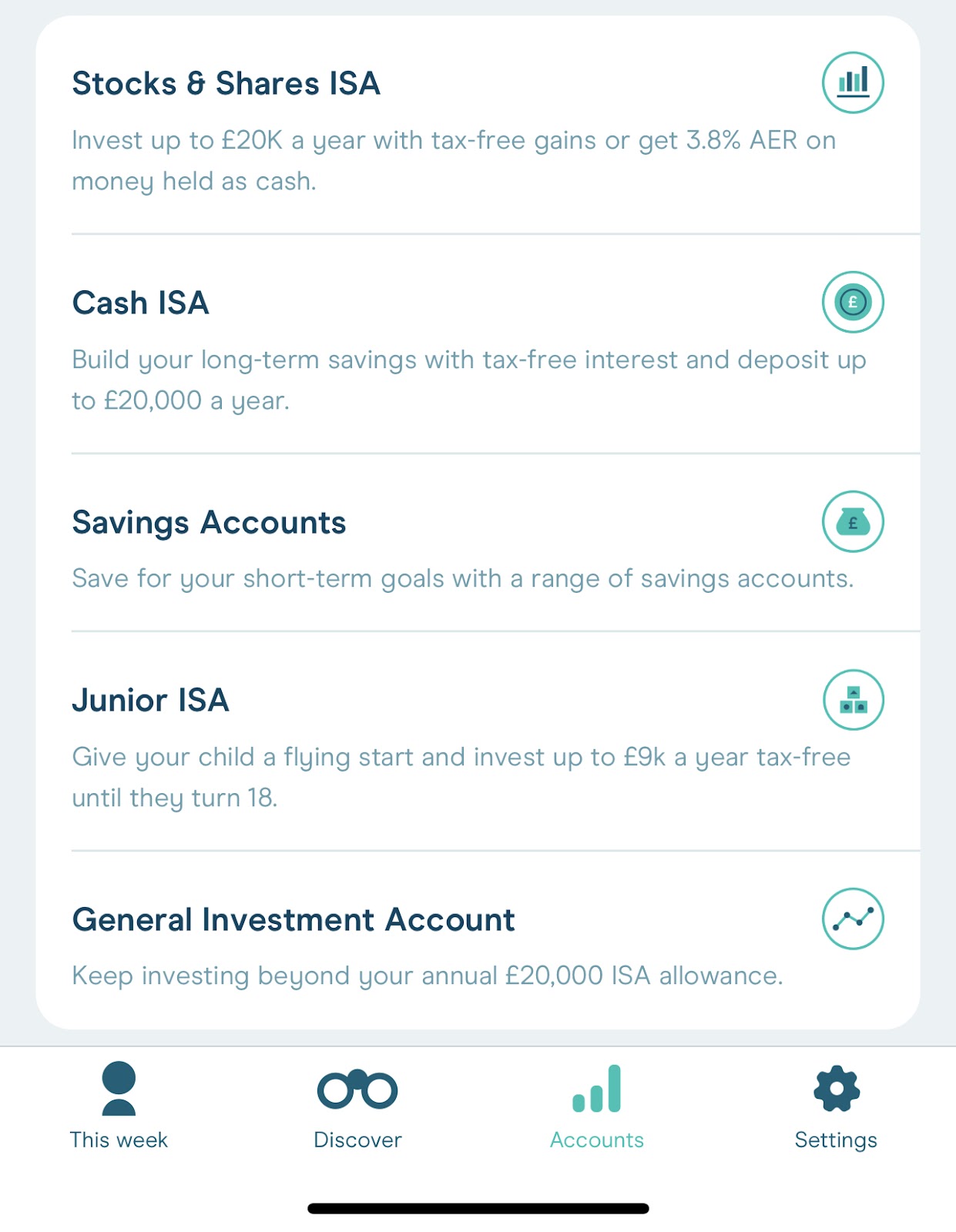

Before you sign up with Moneybox, you’ll need to choose the right account. Currently, there are three main branches of accounts, these being Investment Accounts, Cash Accounts, and Retirement accounts. Each branch has its array of accounts.

Investment Accounts:

The investment accounts available to UK users are:

- General Investment Account: Allows you to invest in stocks and shares without limitation.

- Stocks and Shares ISA: Basic investment account, held in an ISA. You don’t have to pay tax on your capital gains when you hold investments in an ISA. However, the contribution cap is fixed at £20,000.

- Stocks and Shares Lifetime ISA: Same as the basic ISA, with the added benefit of receiving a 25% contribution from the government per year, up to the value of £1,000. However, this account can only be used for buying your first home or as a retirement account.

- Junior ISA: An ISA account designed for under 18s, which is held by the parents/guardians until they turn 18. The limit is £9,000 per year.

Cash Accounts:

- Cash ISA: Allows you to earn interest on your cash in an ISA account, meaning you don’t have to pay tax on any earnings.

- Cash Lifetime ISA: offers a fixed interest rate of 4.25% for the first year, and 3.25% for subsequent years.

- Simple Saver: General savings account, allowing you to deposit and withdraw money at any time. This account offers a 4% interest rate.

- Notice Account: Savings account which requires you to give between 32-120 days of notice before a withdrawal. This account offers better interest rates the more notice you give.

This range of accounts is absolutely excellent. You can also add multiple different accounts to your profile, to help you diversify your money into different areas.

Consider using Moneybox’s multiple account types as a personal financial ecosystem rather than just choosing one. I’ve found success using the Simple Saver for emergency funds, the S&S ISA for medium-term goals, and the LISA for property planning – all managed from a single dashboard. This multi-account strategy helps create natural financial boundaries while keeping everything easily accessible.

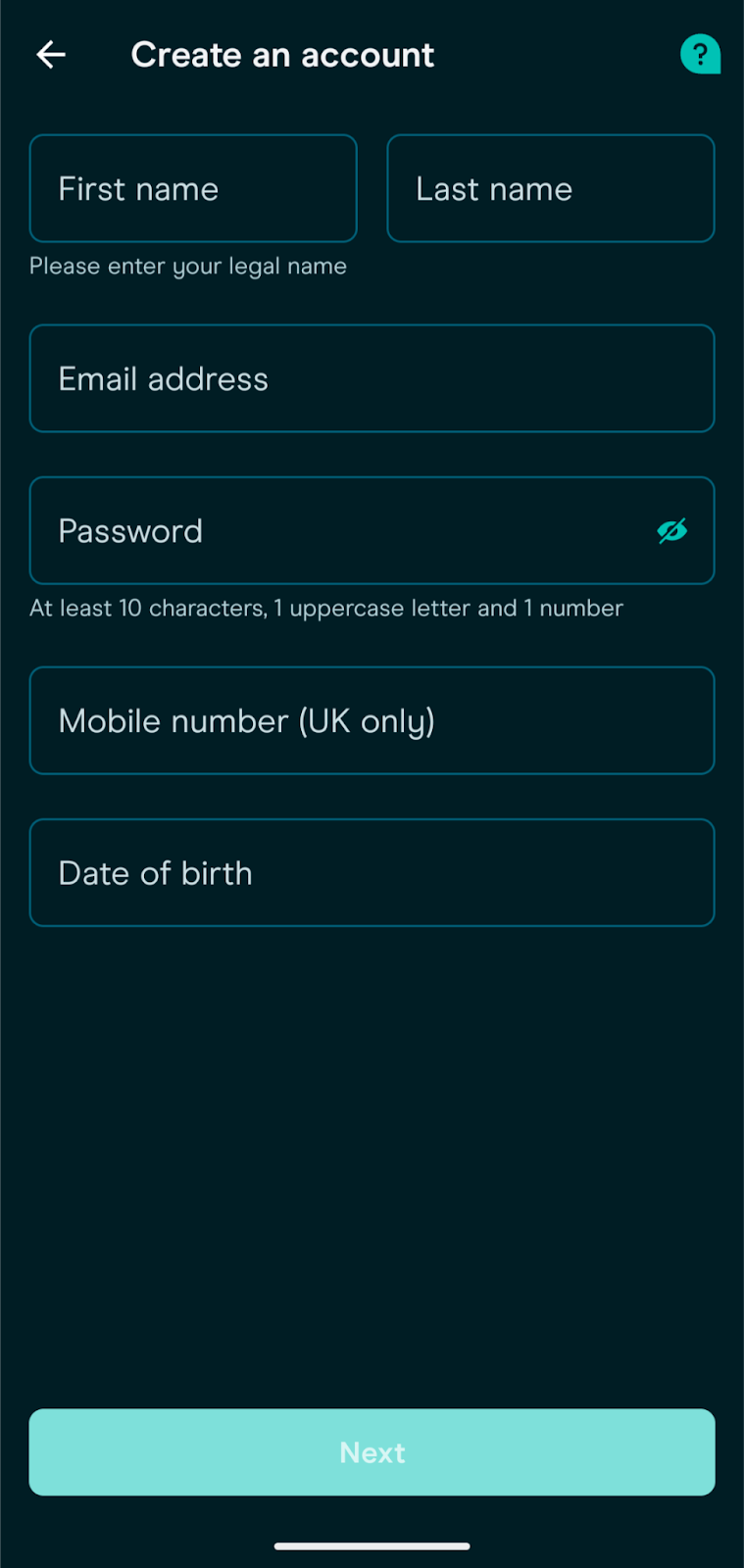

Onboarding

Setting up an account with Moneybox was an incredibly simple process.

Firstly, I was prompted to plug in my basic information like email address, residence, etc. This was easy enough to fill in. I also had to upload some verification documents, including my passport and a utility bill.

The next step involves choosing your account type, from the options listed above. It doesn’t really matter which account type you choose, because you can always open multiple ones once you’ve been initially verified.

After choosing your account, you can choose your initial deposit amount, customise your weekly deposits and optionally turn on spending round-ups.

There are also a few other options such as a payday boost, which automatically takes money out of your bank account on payday. At this point, I was also prompted to set up a direct debit.

Finally, you’ll need to choose your account starting option and fill in a brief questionnaire about your salary and job. After completing these, and receiving verification, your account will be good to go.

I found the account opening process extremely simple to complete. I was able to get going in around ten minutes, and by the time I had filled in the questionnaire, my documents had been verified.

Pros

- Unbelievably good selection of accounts

- Options for cash, investment, and retirement accounts

- Onboarding was quick and efficient

Cons

- None

Deposit & Withdrawal Methods – 4.5 stars

Depositing and withdrawing money with Moneybox is pretty easy.

Deposits are also free to make, and there are a few ways to put cash into your account.

Deposits

If you hold an ISA account, you can deposit £100 or more to your account at any time via bank transfer.

The payment will hit your account instantly, allowing you to put as much or as little money aside as you want each week.

Alternatively, you can set up a direct debit to any account. Moneybox calls this the ‘Weekly Collection Cycle.’ This direct debit is tailored specifically to you, allowing you to adjust the amount you invest based on your circumstances and goals.

As of the time of writing, you can customise your weekly direct debit in the following ways:

- One-off Deposit: Allows you to add a one-time payment to your direct debit. This is perfect if you just received a bonus at work, for instance.

- Payday Boost: Allows you to automatically take a certain amount out of your account when your paycheck lands. This is a great way to force yourself to invest, rather than indulging in liabilities.

- Round-Ups: Moneybox will connect to your bank account, and round up payments to the nearest pound. These round-ups will be automatically saved/invested.

- Weekly Deposits: Allows you to set up a recurring weekly payment for a fixed amount.

Deposits are also completely free to make, and overall, I had no real complaints about the deposit methods available.

I particularly liked the Round-Ups feature, which automatically deposits money for you whenever you spend it on your card.

Withdrawals

Withdrawals are likewise completely free to make. For the general savings accounts, you’ll be able to withdraw money whenever you like.

But, for stocks and shares accounts, you’ll have to sell your assets before receiving payment, This can take anywhere from 3-5 working days.

It’s also important to note that some accounts do have a few legal caveats when it comes to withdrawing money.

For instance, if you withdraw money from a LISA account, without the intention of buying a property, you will forfeit the 25% government bonus. Furthermore, you can only access money in a pension account when you turn 55.

Because of these withdrawal requirements, it’s a good idea to think about how much you can actually afford to invest when you open an account.

While it might feel good to put your life savings away for retirement, this could actually come back to hurt you if you need to pay for an emergency expense. Building a small cash fund of 3-6 months of living expenses is a great way to avoid these situations.

Moreover, it’s crucial to understand that timing withdrawals from investment accounts can be influenced by market conditions. This means that if the market is down, you might receive less than expected from your investments. Thus, having a strategy for when to withdraw based on your financial goals and market conditions is advisable. Additionally, Moneybox offers tools and support to help plan these withdrawals effectively, making it easier to manage your investments according to your financial needs.

Pros

- Deposits and withdrawals are free to make

- Innovative deposit solutions

Cons

- Withdrawals can take a while

Markets – 2.5 stars

Moneybox offers a very limited selection of markets.

If you’re solely looking for long-term growth and to pick a few singular stocks, you may be satisfied by the selection.

However, if you want to branch into other asset groups, such as crypto, CFDs, or bonds, you’ll be left very disappointed.

Funds

Moneybox’s biggest asset class is its fund selection. These are essentially ready-made baskets of stocks, which have been handpicked for growth and risk management.

With Moneybox, you can pick from three different risk levels, these being cautious, balanced, and adventurous. As you might imagine, each ‘level up’ offers much greater potential for capital gains, alongside greater risk.

To put this into perspective, in 2016, the Cautious fund saw an average growth of 15.2%. Whereas, the adventurous funds saw a growth of 27.5%.

On the other hand, in 2022, the adventurous portfolio decreased by 9.2%, while the cautious portfolio decreased by just 5.3%.

These different options allow you to invest in a fund that’s tailored to your goals. For most people, the balanced portfolio is going to be the best option.

However, if you’re perhaps younger, and can afford greater risk, the adventurous portfolio could be a better choice.

ETFs

Moneybox also offers a selection of 12 ETFs for users to invest with. These come from reputable companies like BlackRock and Vanguard and are a great way to build long-term wealth while minimising risk.

US Shares

You can also invest in a handful of US shares. The selection is far from impressive though. Most of the shares offered are for big US names, and there’s very little room to experiment with riskier assets.

If you’re looking to do this, a platform like eToro may be a better option.

Socially Responsible Investments

Moneybox offers a range of what they call ‘Socially Responsible Investments.’

This allows you to invest in companies that are not doing damage to the environment, offer good treatment of employees, and minimise internal corruption.

From a strict financial perspective, investing in this asset group probably won’t offer a great deal of reward.

However, if you are looking to only support ethically sound companies, it is a viable option and something that very few UK investment platforms offer.

Pros

- Pre-made funds are excellent

- Good selection of ETFs

Cons

- Distinct lack of asset classes like crypto, bonds, and CFDs

- Individual shares are limited at best

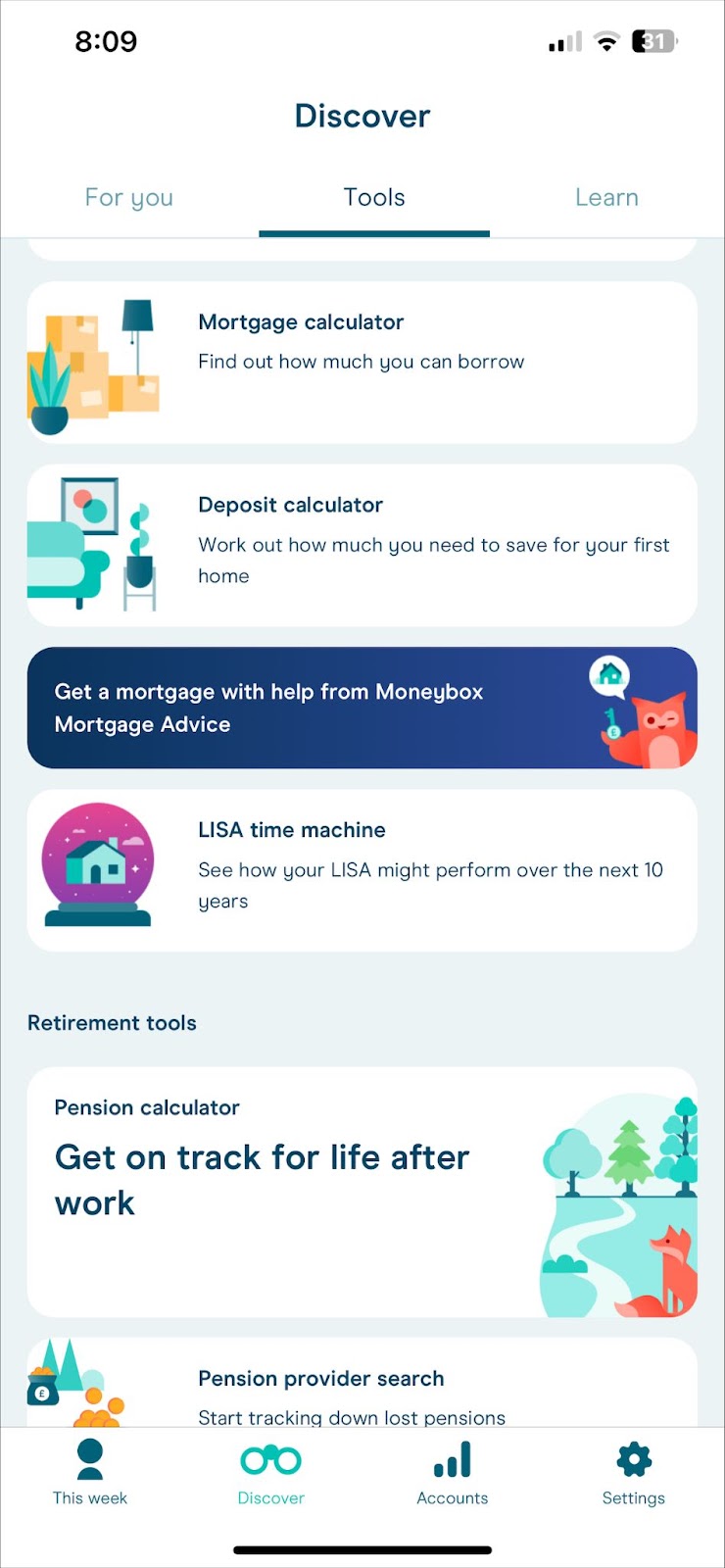

Tools – 3 stars

Moneybox offers a small selection of tools, which are geared toward beginner investors.

You won’t find any advanced research tools, making the selection virtually worthless for an advanced trader.

Tools Offered

Some of the best tools Moneybox offers are:

Pension Calculator

This tool is a sophisticated financial planning instrument that empowers users to make data-driven decisions about their retirement savings strategy. By inputting variables such as current age, desired retirement age, and lifestyle goals, users can receive detailed projections that account for factors like inflation and estimated investment returns.

This comprehensive tool helps individuals visualize the gap between their current pension contributions and their retirement aspirations, enabling them to make informed adjustments to their savings approach.

House Deposit Calculator

The House Deposit Calculator functions as a strategic planning tool that specifically aligns with the unique benefits of the Lifetime ISA (LISA) scheme, including the government bonus. Users can input their regular savings commitments, current LISA balance, and target property price to generate realistic timelines for achieving their home ownership goals.

This tool’s dynamic forecasting capabilities help prospective homebuyers understand how adjusting their savings rate can impact their timeline to property ownership.

ISA time machine

If you’re looking for an advanced portfolio projection tool that utilizes historical market data and compound interest calculations to illustrate potential future scenarios for your investments, this one does it all. With it, you’ll understand the long-term impact of your current investment decisions as it demonstrates how factors such as regular contributions, market performance, and time horizon can affect your portfolio’s growth.

The visual representations provided by this tool make complex financial concepts more accessible and help users appreciate the power of long-term investing.

Research Tools

Moneybox does not offer additional research tools like fundamental data, charts, or an economic calendar.

The platform caters specifically to users who prefer a simple, hands-off approach to investing, avoiding complex graphs and tables that might overwhelm or confuse.

However, this limited toolkit poses a challenge for advanced traders and investors who rely on comprehensive research tools to make informed decisions and strategize effectively.

For those seeking in-depth analysis and market insights, exploring alternative platforms with robust research capabilities may be necessary to meet their specific investment needs and goals. This ensures a more tailored and informed approach to managing investments over time.

Pros

- Calculators make it easy to plan for the long term

Cons

- Zero research tools

- Tools are pretty basic

The absence of advanced trading features, which might seem like a limitation, is actually Moneybox’s hidden strength. By removing the temptation to over-trade or time the market, the platform subtly guides users toward proven long-term investing strategies. This “less is more” approach could potentially save investors from their own worst instincts.

Investment & Trading Platform – 4.5 stars

As an investment platform, Moneybox does its job perfectly.

It’s simple to navigate, isn’t full of useless information, and makes it very easy to see the value of your holdings.

However, I did find the lack of a web version disappointing.

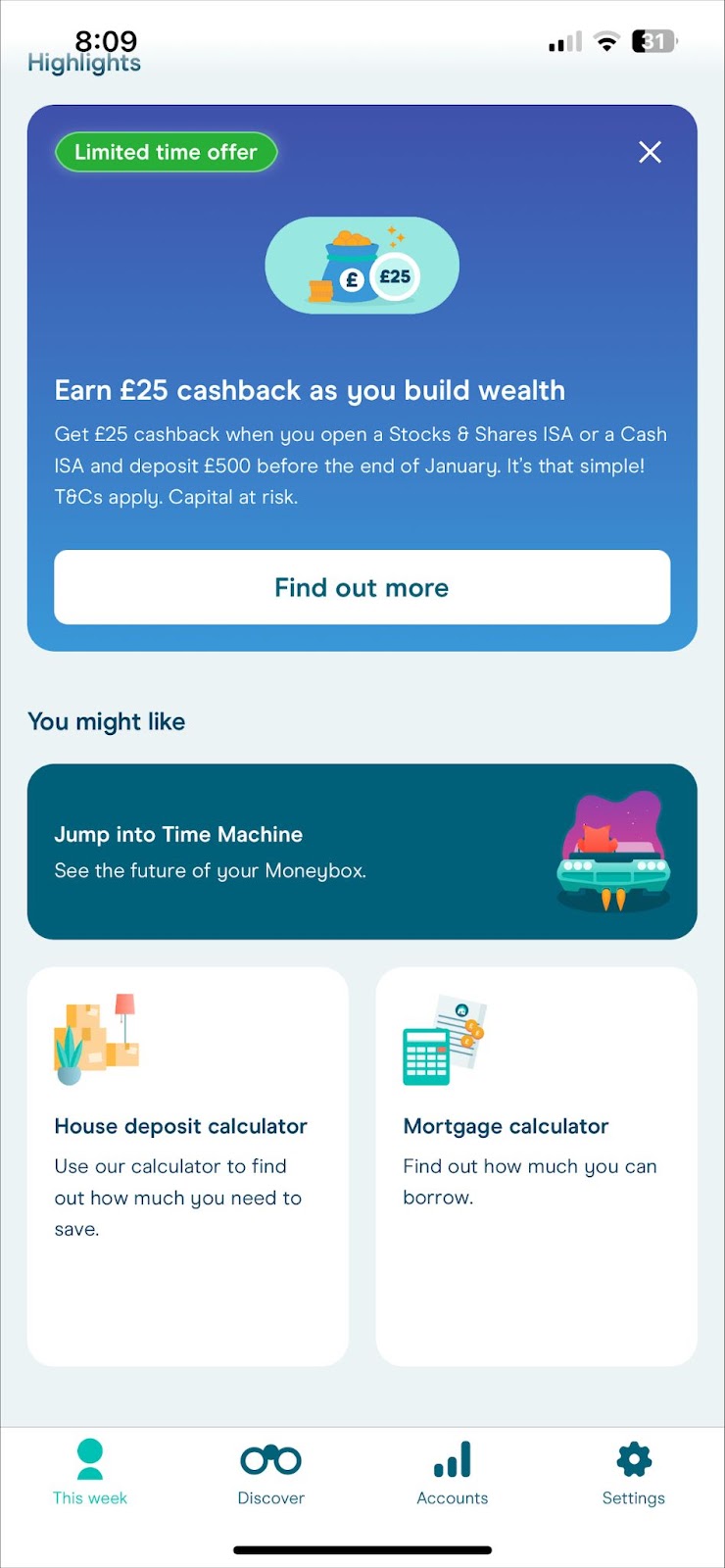

Mobile Platform

When I downloaded the mobile app from the PlayStore, I was immediately impressed by the simplicity of the platform.

When you open up the app, you’ll see a weekly report of how much you’ve saved/invested.

You can then navigate through your accounts via the ‘accounts’ tab at the bottom of the screen.

You can access the educational content and tools through the ‘Discover’ tab, and change your preferences through the Settings tab.

No feature stuck out to me as incredibly impressive. However, the overall layout was very appealing and made it easy to assess your finances at a glance.

User Experience

Overall, I loved my experience with Moneybox, the simplistic layout and light theme made browsing through my accounts and the Discover platform effortless.

Compared to the majority of trading platforms in the UK, Moneybox is outmatched in virtually every way.

However, the purpose of Moneybox is not to cater to every day-trader’s needs – it’s to offer a simple way for everyday people with limited financial knowledge to invest and save their money for the long term.

And when you bear this purpose in mind, it’s honestly hard to fault Moneybox as a platform.

My only real complaint is that there’s no web version.

A lot of people like to see their investments on a bigger screen, and considering that you could be investing something as important as your pension on the platform, it would be nice to see the calculators and projectors on a desktop rather than a phone.

Moreover, enhancing the platform to include a web version could significantly improve accessibility and user interaction, especially for those who prefer or require more detailed analysis of their investments. Additionally, the integration of desktop notifications could aid in keeping users informed about their investments’ performance and any relevant financial news, potentially increasing user engagement and satisfaction. Moneybox could greatly benefit from considering these enhancements to fulfill the needs of a broader audience.

Pros

- Easy-to-understand layout

- Investing is easy

- Handy quality-of-life tools

Cons

- No web version

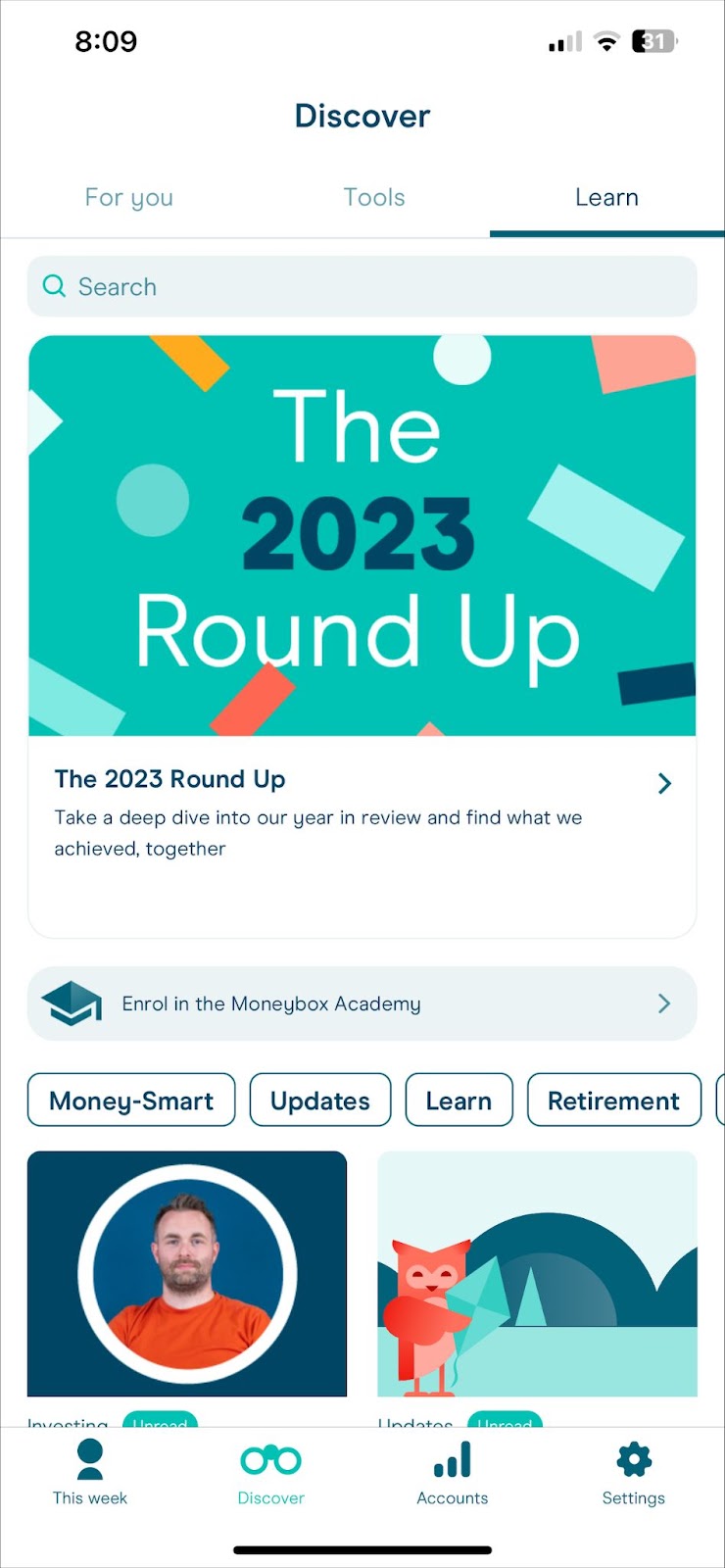

Education – 3.5 stars

Moneybox offers a pretty good range of educational content.

However, it’s geared towards beginners, and if you have a good base of financial knowledge, you may struggle to find value from the platform.

Content

The bulk of Moneybox’s educational content is found in the form of videos and articles, which cover basic financial and investing knowledge. Everything is very visual, which makes otherwise complex topics nice and easy to understand.

Moneybox also offers a training Academy, which is intended to give a complete beginner a basic understanding of the financial world. It’s overall pretty hard to fault, and a great place for any beginner investor to learn the basics.

Real-Time Updates

Beyond the basic educational content, Moneybox offers real-time market updates as well as news coverage of big economic events.

It’s not as extensive as platforms like Saxo but is still a nice touch.

Pros

- Decent selection of blog posts and videos

- Academy is awesome for beginners

Cons

- Educational content is geared toward beginners

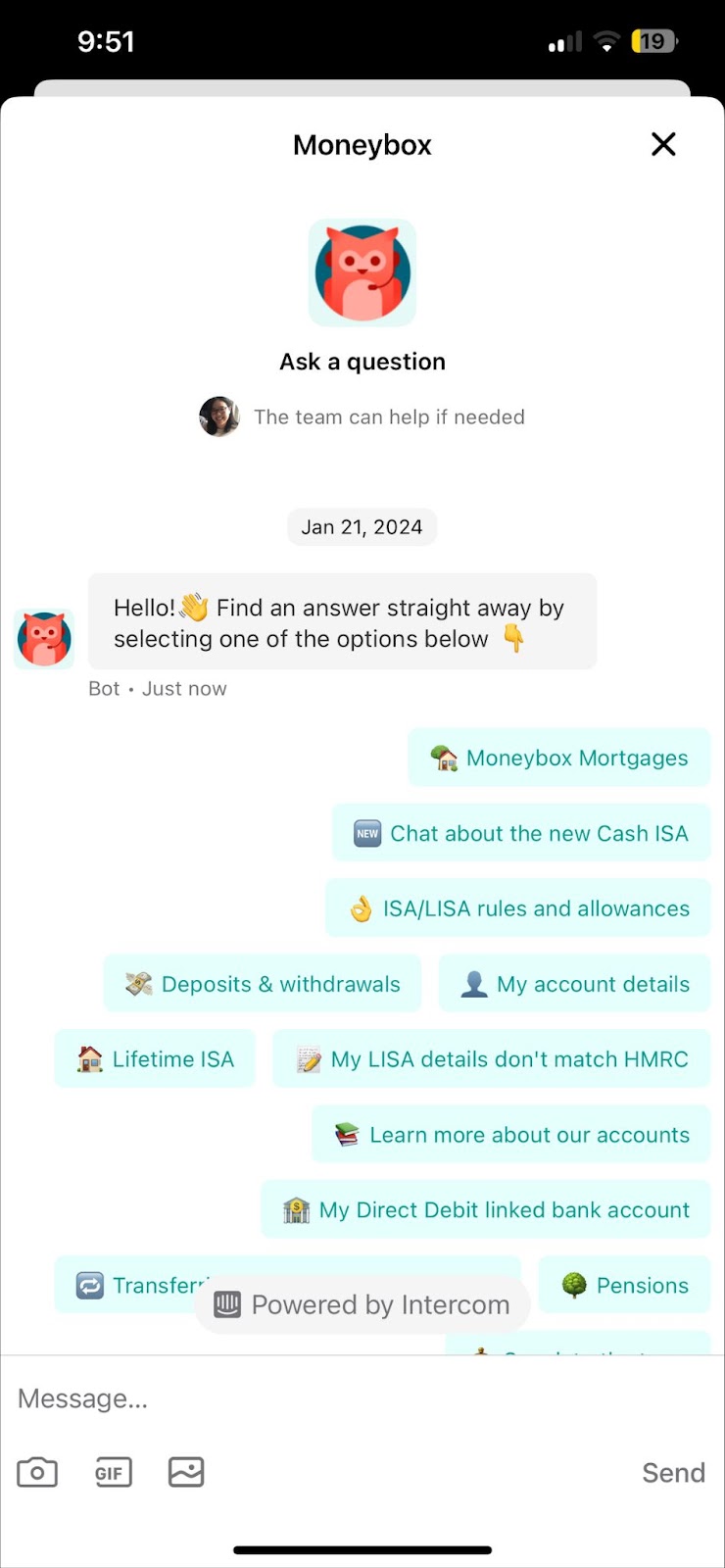

Customer Service – 4.5 stars

On the whole, Moneybox’s customer service is excellent.

You can contact the team seven days a week, the response times are quick and there’s also a handy FAQ section.

However, there’s no option to call in, and I missed 24/7 customer service.

FAQ Section

The first port of call when you have an issue is Moneybox’s extensive FAQ section.

You can find this easily in the app’s menu, and unlike many other platforms, I found this to be a beneficial resource.

All kinds of questions are addressed, from general investment advice to more niche issues surrounding how to use the app.

Messaging Service

If the FAQ section doesn’t answer your question, you can chat with a support agent from the app.

Unlike other platforms such as Spreadex, this isn’t a live chat per se; it’s more of a texting platform. This means that you can exit the app and get on other tasks while you wait for a notified reply.

However, it does also mean that wait times are longer.

I liked this messaging service. The response times, while longer than a live chat service, were pretty quick, and the agent was very knowledgeable and able to answer my questions instantly.

It was also refreshing to not have to stare at a live chat box for minutes at a time, praying for a reply – I simply had to wait for my phone to ding with a notification!

The other way to contact the customer support team is via email. I had a very positive experience with the email service system, thanks to quick response times and relevant replies.

Phone Support

Unfortunately, Moneybox does not offer phone support. However, the messaging service more than makes up for this.

Pros

- The FAQ section is excellent

- Good messaging service

- Fast replies

Cons

- No phone support

- Support is not available 24/7

Recommended For:

- Beginner Investors. I find Moneybox particularly well-suited for those new to investing. The platform’s user-friendly interface and straightforward approach to account setup make it less intimidating for newcomers. The educational content, while basic, provides a solid foundation for understanding investment concepts. For those taking their first steps into the world of investing, Moneybox offers a gentle learning curve with its pre-made funds and simple investment options.

- Long-term savings goals. Moneybox excels for individuals focused on long-term savings objectives. The platform’s diverse account options, including various ISAs and pension accounts, cater well to those planning for significant life events or retirement. I appreciate how Moneybox’s tools, such as the pension calculator and house deposit calculator, help users visualize and plan for their financial future. The ’round-up’ feature and customizable recurring deposits make it easier to consistently save towards these long-term goals.

- Passive investors seeking simplicity. I recommend Moneybox to those who prefer a hands-off, simplified approach to investing. The platform’s pre-made funds and limited selection of ETFs are ideal for investors who don’t want to actively manage their portfolios or get bogged down in complex investment decisions. I find the automatic investment features particularly useful for this group, allowing them to steadily grow their wealth without constant monitoring or decision-making. For busy professionals or those who find the broader investment world overwhelming, Moneybox offers a streamlined, low-maintenance investment experience.

Final Thoughts

In my opinion, if you’re looking for a platform to manage both your general savings and long-term investment portfolio, Moneybox stands out as a solid choice.

It’s a secure and dependable platform that provides a good range of markets suitable for long-term investing strategies.

However, for investors seeking higher-risk assets or advanced trading features, Moneybox may not offer the necessary tools or options to meet these needs.

Exploring alternative platforms with more advanced trading capabilities and a broader range of investment options might be advisable for those looking to diversify their portfolio or engage in more complex trading strategies.

Choosing a platform that aligns closely with your risk tolerance and investment goals ensures a more tailored and fulfilling investment experience over time.

FAQs

Is Moneybox safe?

Yes, Moneybox is considered safe. It is regulated by the Financial Conduct Authority (FCA), which ensures that the platform adheres to strict financial standards and provides an added layer of protection for users. Moneybox implements security measures to safeguard customer data and uses a secure payment gateway for transactions. However, as with any financial service, users should exercise caution and follow best practices to enhance their security.